Lending Options

We have custom capital strategies that can involve traditional bank lenders, CMBS lenders, life insurance companies, mortgage brokers, private capital sources, and varying types of risk transfer mechanisms that can reduce the cash an investor needs to close a transaction.*That said, we believe leverage must be prudently managed based on an investor’s individual needs and tolerance for risk. In this regard, we always recommend speaking with your financial or other professional advisor when making leverage decisions.

Education

Our team believes in the value education. We have licensed real estate brokers, former CPAs, insurance professionals, tax professionals, legal professionals, CCIMs, and most of our staff have college degrees with accounting, business, and finance focuses.

Experience

We have collectively completed over $500M+ in U.S. and international business/commercial real estate transactions. We have experience in most asset classes including, but not limited to, retail, industrial, flex, multi-family, office, and hospitality.

Note that we have limited experience in house when it comes to investing in speculative land investments, special use properties, and certain types of advanced medical properties. If you are looking for such opportunities there are likely better service providers to meet your unique needs.

Relationships

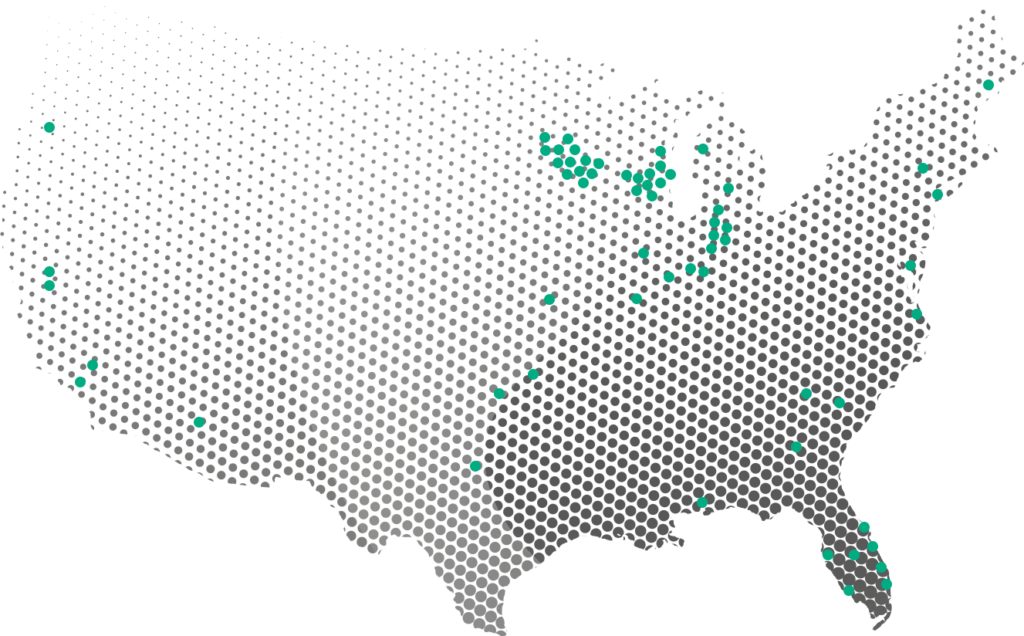

We have a carefully cultivated network of appraisers, title insurance professionals, direct marketers, digital marketers, commercial real estate brokers, property owners, lenders, accounting and legal professionals, and financial advisors who have either worked with us in the past or know of someone who has. We leverage this network to find deals, raise capital, and give great service that lends to people referring business to us.

Scale

We represent scale to the CRE investment community, but more importantly we represent an opportunity for you to scale your portfolio. With us your capital can go farther so you can maximize expiring tax benefits and hopefully build a portfolio large enough to replace your income over time.

Speed

Yes, we close on time and speed is always a driver for hard-to-find deals. However, we offer an opportunity to invest faster than you would if you tried to manage every piece yourself and also raise additional private capital.

Time

After all the dust settles the only commodity that truly matters is time. How we invest and spend it dictates how fulfilled our lives will be. Have you ever thought about the value of your time? Whatever it is, if you are on our website, it is high. Your free time is even more valuable yet. We allow you to maximize the value of your time and help you level up faster.

Underwriting

There are far more reasons not to do a deal than there are reasons to do one. Some people get stuck on analysis paralysis. Others wish they invested more time “in the weeds” before proceeding. We have already built the templates, spreadsheets, external network, and internal resources to have an underwriting edge, so you don’t have to.